5 simple ways to save more money

AD – Blog post shared as part of a paid collaboration with Zopa Bank.

We’ve all experienced times where we wished our past selves had saved a little more money to help our current selves. But how can we go about saving more money?

We’ve teamed up with Talk Twenties sponsors Zopa Bank, who are one of the UK’s leading digital banks, to help you find ways to save more money this year. It’s important we let you know that some of the links in this post are sponsored. #ad

Let’s break down five ways you can save more money this year:

1. Learn to budget

The two things you need to know before you can start saving serious amounts of money is how much money is coming in versus how much money is going out that needs to go on essentials like rent or your mortgage, utilities, groceries and transport, as well as any debt repayments you have. It’s always worth being honest with these amounts, so you’re able to live comfortably. For example, it’s not practical to budget £30 a month for food, when you know that’s not realistic.

If your monthly outgoings are more than what you bring in, that could be a sign you’re living beyond your means, which means saving money is going to be a lot more difficult.

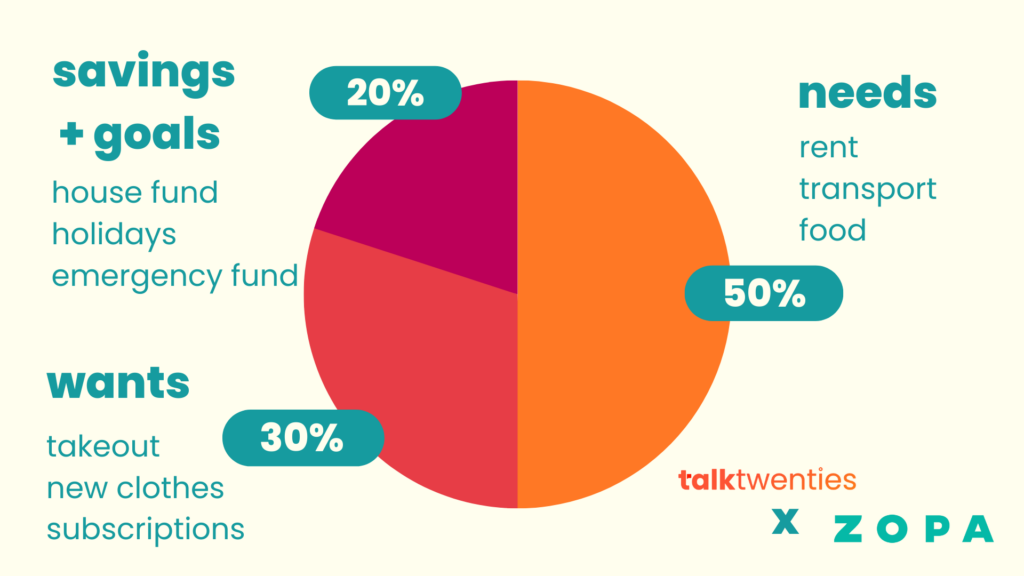

One way to analyse your budget is to look at the 50/30/20 method as a guide. This method suggests that 50% of your income should go on your needs, such as rent, transport, food and whatever you need to survive. 30% of your income should go on the ‘now’, what do you need to enjoy yourself this month and live a more fulfilling life beyond just your needs, for example, subscriptions, social occasions, gifts etc. Finally, a really good position to be in is to be saving 20% of your income towards future goals. Whether that’s buying a home, going on holiday or just saving up a pot of money for emergencies.

Please note: this is just a guide and may not always be achievable or make sense for everyone. For example if you live and rent in a major city then it’s likely your needs would be higher than someone living with parents or guardians. This chart is purely a guide and it’s important you find your own balance that works for you.

2. Set clear goals

When setting your goals, think about what you want to save for, how much you’re going to need and by when. You may want to divide the amount you want to save by the number of months you have left until that date, so you can get a realistic picture of what you’d need to set aside each month, in order to reach your target.

3. Pick the right tools

Keeping your savings in your current account may not be a sensible move if you are trying to save for big goals. Putting some distance between your spending accounts and your savings may help you not dip into them as often.

If you are looking for a savings account that can help you earn interest on top of your savings then take a look at the Zopa Smart Saver. The Zopa Smart Saver allows you to earn interest whilst you save money in different pots for different goals and you can choose to boost the amount of interest each pot gets in return for a longer notice period to access that money. What’s more you don’t need a big amount to get started as you can save from as little as £1. For more information download the Zopa app.

If you’re thinking of getting a Smart Saver, you need to be aware that boosted interest pots are subject to a notice period, the longest of which is 95 days for the highest interest rate. You need to save a minimum of £1 and the interest is paid monthly and is subject to variation.

4. Automate your savings

Once you have figured out how much money you need to be saving, one way to make sure it actually happens is to start automating your savings. If you don’t do this step it’s likely there will be a month where you forget or think about using the money for something else. It takes a lot of resilience but try to think of it as just another bill coming out!

The good news is the Zopa Smart Saver allows you to automate your savings too! Here’s how it works; you tell Zopa to automatically take an amount you decide from your current account and put it directly into your Smart Saver on a day you choose. You now don’t even have to remember to save for your next holiday or whatever your savings goal is because Zopa do it for you, with just a few taps in the app.

If you’re thinking of getting a Smart Saver, you need to be aware that boosted interest pots are subject to a notice period, the longest of which is 95 days for the highest interest rate. You need to save a minimum of £1 and the interest is paid monthly and is subject to variation.

5. Review regularly

Our last and final tip to help you to save more money is to review your savings regularly. The more in tune you are with your finances the more you will be able to save. Have a monthly date with yourself, sit down with a cup of tea and look through your finances.

Ask yourself these questions:

- Did I hit my savings goal this month? If ‘yes’, how did this make you feel? If ‘no’ why not?

- Did I overspend this month? What unexpected costs arose?

- Is there any way I can reduce my expenses to set aside more money for my savings?

Here at Talk Twenties we’re all about making money dates a thing! So spread the word to your friends and family and let’s start helping our future selves be better savers.