Cost of living crisis: what do we do?

AD – Blog post shared as part of a paid collaboration with Zopa Bank.

Cost of living crisis headlines are everywhere. You only have to turn on your TV or scroll on your newsfeed and you’ll come across someone talking about it pretty quickly. But, how does it actually effect us as twenty-somethings and what can we do about it?

We spoke to our audience to figure out some of their biggest worries around the cost of living crisis. We then teamed up with our sponsors Zopa Bank, one of the UK’s leading digital banks, to share some helpful tips for how to make the best of these challenging times! It’s important we let you know that some of the links in this post are sponsored. #ad

As twenty-somethings we’ve all be told if we just stopped buying takeaway coffee or avocado on toast, we’d be able to afford a house but we all know that’s hardly going to shift the dial! Navigating the world of finances, when we’ve been taught nothing about it in school, can be a tricky task… so let’s get into some key worries that some of you are experiencing right now.

Paying off existing debt in the cost of living crisis

“I’ve got debt from 3 credit cards that I’ve been trying to pay off for a couple of years. With everything going up I just don’t know how I’m going to manage this anymore.” Alicia, 29

Many are worried about paying off existing debts during this time, so don’t feel alone if this is the case for you too. It could be that you have a credit card or an overdraft, or have used Buy Now Pay Later in the past. Loads of us borrow bits here and there as we start working or go through higher education.

However, having lots of little pots of borrowing in different places can be hard to keep track of. You might find yourself frequently asking yourself ‘when does that payment come out?’ or ‘do I have enough money to cover these different payments?’. We know first hand that it can get a bit stressful.

If you struggle to keep track of different loan repayments then it might be worth looking into a debt consolidation loan. It means it’s just one regular payment per month, so you know each month ‘Ok, I need to make sure I have £100, or £200 or whatever your monthly repayment amount is, in my account on the same day every month to pay towards my debts’. It makes it so much easier to track.

Also putting everything into one loan could mean you pay less interest overall. Instead of borrowing from different places, all charging different interest rates, you can put them all on one interest rate. Some people do find that it saves them interest in the long run and it’s one of the few genuine areas to make savings in this current climate.

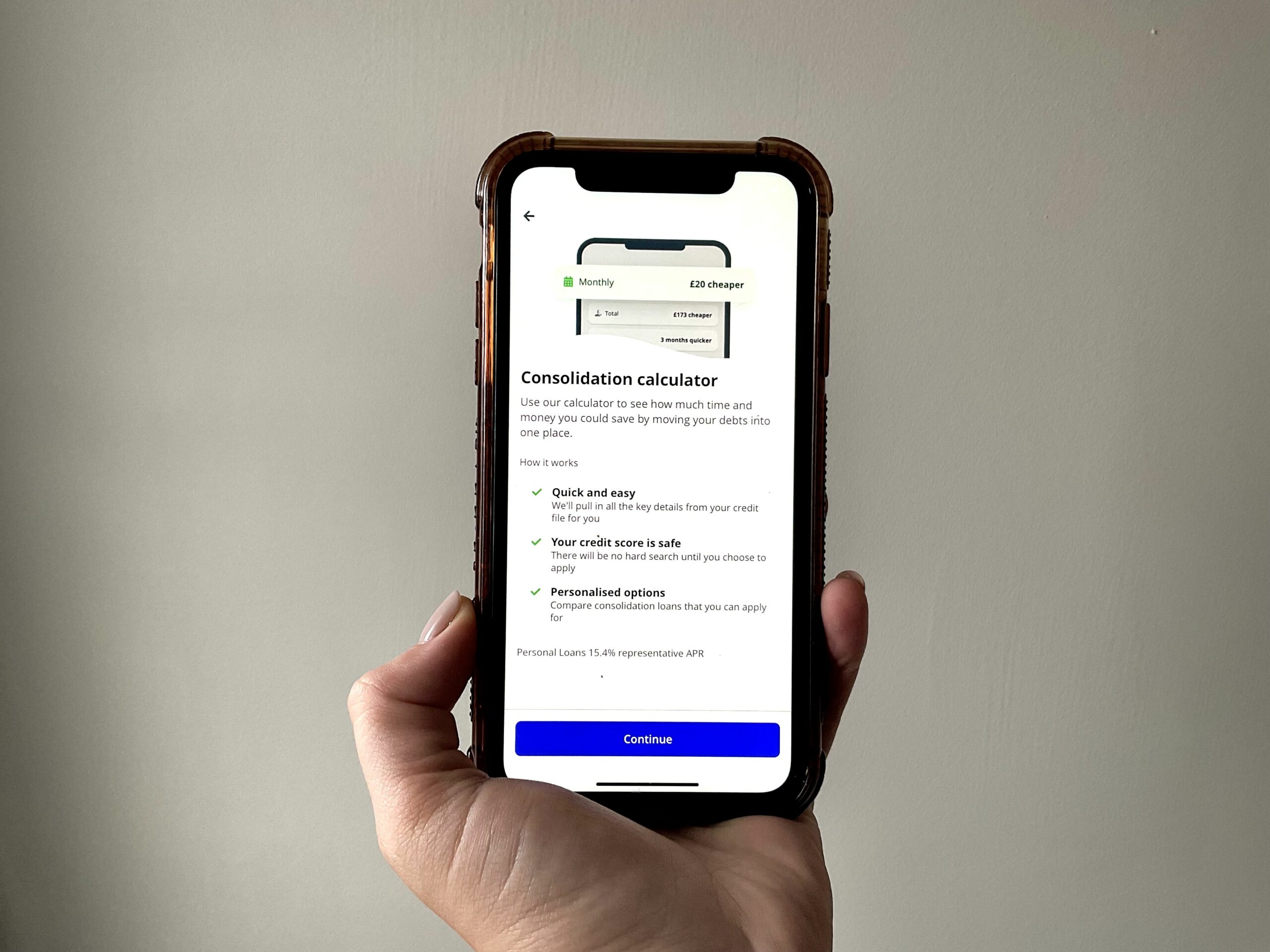

If you’ve got any existing debts – could be on a credit card or a loan – you can use Zopa’s Debt Consolidation Calculator in their app to see if you could save money on interest, or pay off your debts quicker, by consolidating them with a Zopa loan. Their personal loan representative APR is 15.4%.

Borrowing in the cost of living crisis

“I want to take out a loan to buy a new car, to get me to and from work, but I’m worried about taking on a loan I can’t manage and not being able to afford my repayments” Megan, 24

Now more than ever it’s important to consider your own financial resilience so that you can make the best decisions for your current situation. Getting a clear picture of your financial health will mean you’re much better equipped to understand what borrowing you can afford to do in this changing macro-economic climate.

Zopa have a great, simple to use tool called Borrowing Power which is free to use in their app. Borrowing Power will give you a clear view of how Zopa see your financial health with a simple 1 – 10 rating – with 10 being that your financial health is in good shape. If you don’t score a 10, it’ll give you personalised tips on what you need to do to improve your score over time. The app will also show you exactly which Zopa loans you’re eligible for and what APRs or Annual Percentage Rates, you can unlock when you boost your score (personal loan representative 15.4% APR).

Car finance

If, like Megan, you’re looking to borrow money specifically to purchase a car, then there are a number of options. If you have a good credit rating, you could use a personal loan to buy the car. This method means you’ll own the car fully from the minute you take out the loan – essentially, you’re borrowing the money personally, you’re simply choosing to buy a car with it. This can be good if you’re not sure how long you’ll own the car, but it does mean that it’s likely to have the highest monthly payments as the vehicle is not used as security against the loan. Zopa’s unsecured personal loan representative APR is 15.4%.

Another option would be to consider hire purchase (HP). With this type of loan, you won’t own the car fully until you’ve paid every single monthly payment as the loan will be secured against the vehicle. A bit like a mortgage is secured against the value of the property – if something changes and you can’t afford to repay the amount in full – the finance provider will be able to repossess the car, and use its value to clear the remaining debts against it. This generally means your monthly payments are likely to be less than an unsecured loan, but does mean you won’t own the car until you’ve paid fully. However, once you’ve paid up – the car is 100% yours. With hire purchase finance, there are no restriction’s around the amount of mileage you can do in the vehicle without incurring any fines. Zopa’s car hire purchase is 13.9% representative APR.

Finally, another way to finance a car could be personal contract payment (PCP). This is the most common type of car finance in the UK. Like hire purchase, the loan amount is secured against the vehicle. PCP’s tend to last 3- 4 years, and you essentially ‘lease’ the car. You’ll put down a deposit and then make monthly payments against the car. Importantly, you’ll need to agree on an annual milage cap, and you may incur fines if you’ve gone over this agreed milage once your PCP is up.

When your PCP comes to an end, you’ll have 3 options:

- Pay an optional final payment. This is the value of the car minus the total amount of monthly payments you’ve made during your PCP term. Depending on the value of the car, the balloon payment could be a few thousand. One the balloon payment is made, the car is all yours.

- Hand the car back and walk away.

- Hand the car back and enter into a new PCP on a new vehicle and start the whole process again. The value of any PCP payments you’ve made on your old car will carry forward to your new car. So say you made a total of £2,000 worth of payments on your old vehicle, this £2,000 value will cary over to your new car. It’s likely that your new car will be worth more than your old car though, so you’ll still need to ensure you can make the monthly payments on the new car.

It’s worth checking out Zopa’s Car Finance offers for more information.

Saving in the cost of living crisis

“I want to keep saving during this time but I’m worried about locking away any savings and then not being able to access it in an emergency” Jack, 24

The world can feel a bit uncertain right now but the uncertainty doesn’t mean we should all stop thinking about the future. No matter your situation, getting some savings behind you and building up a pot of money you can lean on is super important.

We all have different savings goals in mind, maybe you want to build an emergency fund, save for a holiday, Christmas presents or a fun pot for your next girls/lads/pals weekend away – or maybe you want to do all of these things. With most savings accounts you’ll only be able to save into one pot, which means all of your above goals are lumped together and it can be hard to track, but there is another way! A number of saving accounts are popping up which allow you to split your savings in to helpful pots so you can keep track of where you are at with each of your savings goals.

Zopa’s Smart Saver lets you save in different pots for different goals from as little as £1, all the way to 85k if you’re lucky enough to have that! You can also choose to boost any of your pots in exchange for different notice periods. So, say you have a holiday booked in a year’s time and you’re saving up some spending money, you could select a notice period of 95 days and you’ll gain a higher rate of interest on that specific pot. Just remember to give notice 95 days out from your holiday and the money is ready to go with extra interest on top!

If you want an emergency pot, you can set up an access anytime pot with no notice period, so you can access it 24/7. Then, if you’ve got other goals, you can set up other pots for your long term goals, like for example, saving for that ring to propose to your other half. All managed in the Zopa app.

We find that managing your savings in this way really helps for long term and short term savings goals because it’s all in one place, but with specific goals behind each pot.

Our final note on savings is to try not to leave any savings or even money you’ll spend later in the month, lazing around in your current account. Moving it to an access anytime savings account will ensure you are earning interest all the time on your money right up until you need to spend it and therefore getting the best out of your money in the current climate.

Energy bills in the cost of living crisis

“I’m at a loss with my energy bills, it feels so complicated to change providers, but I worry that I’m not getting a good deal” Darren, 27

We hear ya!

With all this talk of energy prices, how on earth do you know if the tariff or deal you are on, is the best one for you? No-one wants to spend hours trawling individual websites and making their own comparisons but there are easy ways to do this through energy comparison providers.

Zopa’s Energy Switch in their app shows you very simply how you can switch energy or broadband suppliers and save. In the app you can see individual offers and how much you could save.

Final thoughts

If you’re worried about the cost of living crisis, please make sure you speak to someone you trust about your concerns. A problem shared, is a problem halved – don’t feel like you have to go through this alone. Helpful advice can be found on Citizens’s Advice Bureau, Payplan and the Samaritans websites.

There are many more blogs on our Finance and Money section of our website that can help you figure out all the stuff you were never taught in school about money and don’t forget to tune into the Talk Twenties Podcast for more advice and stories of navigating life in your twenties.